ASM Dividend 2024 Payout Date: Dividen Amanah Saham Malaysia History

ASNB telah menyediakan dana yang dikenali dengan Amanah Saham Malaysia.

Ia merupakan dana harga tetap di bawah PNB, terutamanya kepada pelabur Bumiputera dan bukan bumiputera.

Walaubagaimanapun, pulangan yang diberikan adalah lebih rendah berbanding ASB malaysia.

Tetapi ia masih mampu memberikan pulangan dividend yang stabil untuk jangka masa panjang. Kali terakhir, semakan kami, kalangan pelabur menikmati pulangan sebanyak 4,5 peratus bagi tahun kewangan yang berakhir 4.5 peratus yang lalu.

Senarai Kandungan Penting:

Bayaran Asm Dividend History

Di atas adalah sejarah dividen amanah saham malaysia untuk 5 tahun terakhir bagi ASM, ASM2 Wawasan dan ASM3.

- BACA SINI >> top dividend stocks malaysia

- BACA SINI >> harga saham malaysia terkini

- BACA SINI >> dividen bank rakyat setiap tahun

| YEAR | Amanah Saham Malaysia | Asm2 Wawasan Dividend | ASM3 |

|---|---|---|---|

| 2023 | 4.5% | 31 August | 30 September |

| 2022 | 4.0% | 3.75% | 3.75% |

| 2021 | 4.0% | 4.0% | 4.0% |

| 2020 | 4.25% | 4.0% | 4.0% |

| 2019 | 5.50% | 5.0% | 5.0% |

Ia menunjukkan sedikit perbezaan dari segi kadar dividen yang diterima oleh pelabur sepanjang tahun.

Terdapat peningkatan positif untuk amanah saham malaysia, bagaimanapun, dividend untuk ASM2 dan ASM3 terus menurun sepanjang tahun.

Bila Tarikh Bayaran Dividen ASM

Bagi tahun 2023, pembayaran dividen asm adalah seperti tarikh yang dinyatakan di bawah;

| YEAR | Amanah Saham | ASM2 WAWASAN | ASM3 |

|---|---|---|---|

| 2024 | 28 MAC 2024 | 28 MAC 2024 | 28 MAC 2024 |

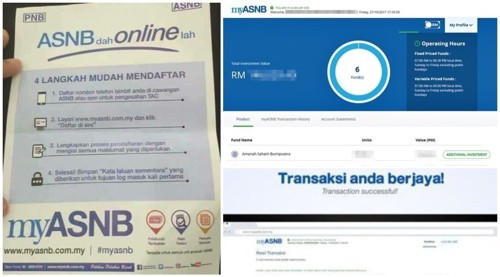

Cara Buka Akaun Amanah Saham Malaysia Online

Kepada mana-mana pelabur yang berminat untuk melabur dalam amanah saham Malaysia boleh beli unit tersebut secara online.

Di bawah ini adalah langkah demi langkah dan cara untuk memulakan pelaburan dengan ASM Malaysia.

- Mula-mula, download aplikasi ASNB, dan mula daftar akaun secara online.

- Sila sahkan akaun anda sendiri dengan muat naik salinan kad pengenalan dan foto diri sendiri.

- Isikan nama penuh anda dan password yang anda ingin tetapkan

- Setelah proses registtration dan pendaftaran asm account selesai, sila login masuk dengan maklumat yang telah ditetapkan.

- Di bahagian menu utama, pilihan dana pelaburan yang anda ingin iaitu ‘Amanah Saham Malaysia’.

- Buat bayaran untuk jumlah unit yang anda ingin laburkan.

Walaubagaimananpun, perlu diingatkan di sini unit ini sangat sukar untuk anda beli. Sangat terhad. Siapa cepat dia dapat!

SUMBER: ASNB

Berapa Pelaburan Minimum Untuk Amanah Saham Malaysia

Sekarang ini ASNB telah mengumumkan peningkatan peruntukan unit baru sejumlah RM5 juta untuk beli dan melabur.

Pelabur boleh membuat pembelian tambahan bagi unit yang dilaburkan melalui akaun ASNB mereka, tertakluk kepada ketersediaan sehingga 100 ribu unit.

Pada ketika ini, pelaburan minimum dalam amanah saham malaysia ialah 10 unit.

Beza Dividen ASM VS ASM2 Wawasan vs ASM3

Amanah saham malaysia ASM, dividend asm2 wawasan 2024 dan dividen asm3 2024 adalah instrumen pelaburan yang menawarkan unit harga tetap.

Satu unit amanah saham malaysia bersamaan dengan RM1 jika anda cuba mencari perbezaan asm1 asm2 asm3. Kesemua pelaburan ini adalah dalam bentuk wang tunai dan Skim Pelaburan Ahli KWSP.

Jadual 1.0 menunjukkan perbezaan antara asm dividend vs asm2 vs asm3.

Tiada had masa yang memerlukan pelabur menarik balik pelaburan mereka.

| ASM | ASM 2 WAWASAN | ASM3 | |

|---|---|---|---|

| TARIKH MULA DANA | Dilancarkan pada 20 April 2020. | Dilancarkan pada 28 Ogos 1996. | Dilancarkan pada 5 Ogos 2009. |

| PECAHAN ASET | Kelas aset bercampur yang digabungkan sebanyak 73.08% dalam ekuiti dan 26.92% dalam instrumen pasaran lain. | Kelas aset bercampur yang menggabungkan 79.39% ekuiti dan 20.61% instrumen pasaran lain. | Kelas aset bercampur yang menggabungkan 73.5% daripada ekuiti dan 26.5% daripada instrumen pasaran modal lain. |

| PELABURAN SEKTOR | Melabur dalam sektor kewangan | Melabur dalam kewangan dan sektor perkhidmatan | Melabur dalam servis & perkhidmatan dan perdagangan |

| TARIKH AKHIR KEWANGAN | 31 MAC | 31 OGOS | 30 SEPTEMBER |

ASM Dividend 2024 VS FD

BACA SINI >> dividen fixed deposit paling tinggi

Dividen amanah saham malaysia dan Simpanan Tetap (FD) adalah bentuk pelaburan paling selamat, berisiko rendah dan terjamin dalam pasaran kewangan.

Walaubagaimanapun, Amanah saham malaysia dan FD sedikit berbeza kerana kedua-duanya mempunyai faedah dan kelebihan yang tersendiri.

Amanah saham ialah dana pelaburan ekuiti dengan unit amanah harga tetap RM1.00 seunit. Dana ini telah diperkenalkan di bawah Amanah Saham Nasional Bhd (ASNB).

- Ia diperkenalkan dengan tujuan menyediakan peluang pelaburan jangka panjang kepada pelabur dengan pulangan yang kompetitif berbanding pelaburan lain.

- Selain itu, tiada had jumlah pelaburan bergantung kepada kuota unit yang ada

- Anda boleh memulakan pelaburan awal serendah RM10.

FD pula,adalah dana pelaburan yang membolehkan pelabur memperoleh kadar faedah atau kadar keuntungan tetap dalam tempoh masa yang dinyatakan.

Ia boleh menjadi pulangan selama tempoh 3 bulan, 6 bulan, 12 bulan, dan seterusnya.

- Pelabur boleh memperoleh keuntungan daripada jumlah yang dilaburkan dalam tempoh tersebut.

- Sebaliknya, ia adalah pelaburan yang selamat dan terjamin dengan pulangan yang rendah dalam tempoh masa tersebut.

- Tidak seperti Amanah Saham, FD hanya boleh ditarik balik selepas sampai tempoh matang tertentu.

- Oleh itu, FD telah diperkenalkan dengan tujuan untuk memaksimumkan simpanan pendeposit dalam jangka pendek.

Cara Pengiraan Dividen ASM vs KWSP

Amanah Saham Malaysia dan Kumpulan Wang Simpanan Pekerja (KWSP), kedua-dua pelaburan memberikan dividen kepada kalangan pelabur untuk sepanjang tahun.

Walau bagaimanapun, kedua-duanya menawarkan kadar dividen yang berbeza bergantung kepada keuntungan bersih yang diperolehnya.

- Dividen ASM adalah pelaburan berdasarkan dana pendapatan yang dilaburkan oleh pelabur dari semasa ke semasa.

- Bagi tahun taksiran, setiap pemegang unit atau pelabur berhak menerima pembayaran dividen.

- Kadar dividen akan diumumkan oleh lembaga pada akhir setiap tahun.

- Ia akan memberi manfaat kepada pelabur mengikut bilangan unit yang diperoleh oleh pemegang unit.

Tambahan pula, setiap individu yang mencarum kepada KWSP berhak menerima dividen setiap tahun kewangan.

- Dividen akan dibayar kepada ahli KWSP berdasarkan dua (2) jenis simpanan; simpanan konvensional dan simpanan Syariah.

- Secara amnya, insentif persaraan melalui caruman bulanan ini akan layak menerima pembayaran dividen, yang membantu pencarum meningkatkan simpanan mereka kerana ia merupakan sebahagian daripada pelaburan jangka panjang.