Maybank2e Login: Register M2e Online

This is an online banking application that is designated for corporations or companies to perform online transactions. Other than that, m2E malaysia also offered services such as account inquiries and generating company reports online.

This application is available in the form of a web-based application that is accessible at their portal and a mobile application that can be downloaded to the user’s mobile phone.

There are many attractive features offered by this portal to increase the effectiveness and efficiency of the companies’ online financial transactions.

It can be done anytime and anywhere, and at the same time, the process of payment disbursement is also fast. Therefore, online banking transactions by using this portal are worth managing the business finances.

How To Apply And Register Maybank2e Malaysia

- READ MORE >> uob login

- READ MORE >> how to transfer tng to bank

- READ MORE >> how to buy shares in malaysia online

This online banking can only be accessed once the registration is made.

Registration for this online banking can be done online. Below are the ways to apply and register;

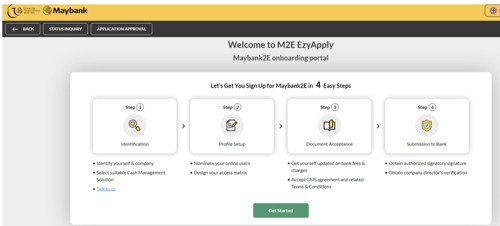

- Browse the website at https://www.maybank2e.com

- Click on the “Ezy Apply” button.

- Then, click on the “Get Started” button.

- Fill up all the required information about the company, which includes the company’s identification and profile setup.

- Upload the supporting documents from the company for application approval.

- Submit the application to the bank by clicking on the “Submit” button.

- Finally, Maybank2E registration has been successfully completed.

How To Access M2e Login Maybank2e

Once the application is approved and registered, the user, such as the financial officer of the company as an administrator of this account, can start to login to the account.

Below are the ways to access maybank2e;

- Browse the m2e login portal at https://www.maybank2e.com

- Fill up the corporate ID, user ID, password, and country of the company.

- Then, click on the “Login” button.

- Request and enter the OTP received.

- Finally, the login is successful.

How To Change My Transfer Limit

The administrator of the account can change or modify their transfer limit to fit their daily financial transaction activities.

Here are the ways to change the transfer limit;

- Browse the official portal and login to the account.

- Click on the “Setting” part.

- Then, click on “Pay & Transfer” and select “Transfer Limit.”.

- After that, the user can make the limit changes and click on “Save Changes” once it is modified.

- The user needs to request “Secure Verification” or “SMS TAC” to approve the changes made.

- Finally, click on the “Confirm” button, and the new transfer limit is applicable to the next transaction.

How To Check My Transaction History

Every transaction that has been done through the account will be recorded, and it can be generated in the form of a bank statement.

The user can check their transaction history once they have made any financial transactions.

Below are the ways to check the transaction history:

- Browse the official portal.

- Log in to your account.

- On the main page, click on the “Cash” tab.

- Then, select “Transaction Activity” under the Today’s Inquiry section.

- Fill up the product and account number and click on the “Search” button.

- Finally, the transaction history will be displayed for the user’s reference.

How To Add A Favourite Account

The user can choose to favorite the account to make it easier for them to do any transaction.

Below are the ways to favorite the account;

- Browse the portal and log in to the account.

- At the main menu, click on the “Administration” tab.

- Then, select “Beneficiary Inquiry” and click on the “Add” button.

- Next, fill up the beneficiary account that needs to be favorited.

- Once completed, click on the “Preview” button.

- Finally, click on the “Submit” button for approval to add a favorite account.

Between Maybank2e Malaysia vs UOB Infinity Which One Better

Both are digital online banks for business purposes and transactions.

However, there are slight differences between both types of online banking.

First of all, this online banking platform introduced by the banking institution, Maybank Berhad.

It provides an online solution to any cash management and trading activities made by the users.

It can also be accessed worldwide, such as in China, Hong Kong, Philippines, Cambodia, Indonesia, and more, anytime and anywhere.

Users can experience various great features and benefits that apply to small, large, and multinational companies.

Thus, this can be browsed online through https://www.maybank2e.com

Meanwhile, UOB Berhad also provides a digital online banking platform to its customers who own the business.

Any business transaction can be done through UOB Infinity. It offers efficient cash management and trading services that users can access 24 hours a day.

This platform also provides various services to its customers across the border.

Hence, this UOB Infinity can be applied and registered online through https://www.uob.com.my

Therefore, both online banking platforms have pretty much the same capabilities.

Even so, Maybank2E is much better than UOB Infinity, as it is widely used among countries around the world and its features fit all business requirements.

Different Between Maybank2u vs M2e Malaysia

Maybank2U and Maybank2e are the products and services provided by the banking institution of Maybank Berhad.

Both play a significant role in fulfilling the financial management needs of customers, whether they are individuals or corporations.

Generally, Maybank2U is an online banking application that is designated for individual financial transactions and activities.

All features and benefits offered on the Maybank2U platform are specifically focused on the financial management and solutions of the individual.

It includes personal savings accounts, fixed deposits, ASBNs, current accounts, and many more. It is for personal daily use to transact financial activities.

Apparently, Maybank2U is different from maybankk2e. This online banking platform that is established for business activities.

Business transaction activities can be done online through this application.

It can be used and accessed worldwide by companies that involve other foreign companies’ businesses.

This will make the business activities of the companies efficient and effective, as all financial information can be gained online.

Thus, this online banking is widely used by most of the corporate bodies in Malaysia and other ASEAN countries.

How To Contact Maybank2e Customer Service

Any users who encounter any problems with their account may seek help by calling the m2e maybank hotline.

The customer service officer will entertain them by solving their problems.

The contact information for any online banking inquiries can be referred to through m2e Maybank website.

Thus, the hotline number would be 1-300-88-7788.

FAQ

1. What is the limit of FPX?

A company is a business entity that, most of the time, involves a huge number of financial transactions within a day.

However, there is a limit to the number and amount of transactions that can be made by the company.

The minimum limit that is set in the account is RM1.00 for every transaction, and it can be up to the maximum amount, which is limited to RM30,000 in a transaction.

Meanwhile, the maximum transaction that can be made in a day is up to RM50,000.

This limit has been set to make sure that the transaction made by the company is legit.