PB Public Bank Share Price history: Pbb Stock History

Public Bank Berhad (PBB) is a banking institution based in Malaysia that runs financial services and offers stock banking to stockholders. It includes stock investment activities. PBB was founded in 1966 and operated in all segments related to the finance sector.

The major shareholders of the PBB shares’ are among insiders and institutions, which are Consolidated Teh Holdings Sdn Bhd, Employees Provident Fund Board, Kumpulan Wang Persaraan, Amanah Saham Bumiputera, and State Street Bank & Trust Company.

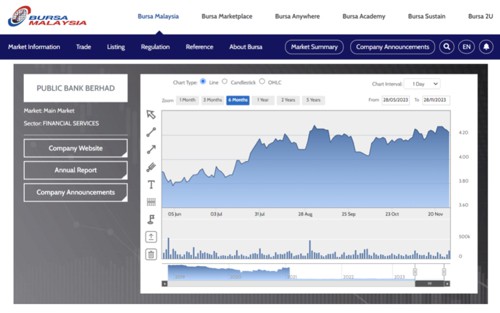

According to the financial performance report of PBB, there was a slight increase in revenue for the bank over the year up until 2023. However, in terms of earnings per share (EPS), it is illustrated that there will be a slight decrease from RM8.83 to RM8.34 per share in 2023. Currently, the price share of PBB is RM4.22 (as of November 28, 2023).

Furthermore, the movement of the share price in PBB is changed accordingly depending on the stock exchange market, i.e., Bursa Malaysia. Hence, investors play a significant role in monitoring and analyzing the share price trend from time to time so that their investment activities perform well on the stock exchange market.

How To Online Check Public Bank Share Price Today

Investors who are interested in investing in the PBB share price today can monitor the trend of the share price from time to time online.

- READ MORE >> maybank dividend

- READ MORE >> highest dividend stocks malaysia

- READ MORE >> public bank dividend 2024 payment date

It can be checked through the official website of Public Bank berhad or on https://www.bursamalaysia.com

Investors can monitor the movement of the share price issued by Public Bank from previous years up until the current share price.

By doing so, investors can make comparisons over all the years the shares have been issued.

On the other hand, investors can also predict the performance and sustainability of the PBB for short-term and long-term performance.

SOURCE: BURSA MALAYSIA

Public Share Price: Who Is The Largest Shareholder

A shareholder is the legal owner of the company. Generally, they have ownership over the company or institution, which comes with certain rights and obligations.

They invested their capital in the company to operate the business over the long term and sustain it over a long period of time.

Not only that, they are entitled to receive a yearly dividdend based on their shares invested in the company.

Hence, the largest shareholder of Public Bank is Teh Holdings Sdn. Bhd., which holds the highest amount of shares in Public Bank, which amounts to 21.64% of the total equities.

Why Public Bank Stock Price Drop

Recently, the share price of PBB has represented a downtrend in terms of its performance.

The PBB share price history, which was previously perceived to be sustainably solid and concrete due to its great banking activities, seems to be falling like a rock for some reasons.

Analysts said that the decline in the share price of PBB is due to the current harsh economic weather, which creates pressure on investors to buy and sell the shares.

Public Bank, the third largest banking institution in Malaysia, has shown a weak share price as the bank is currently facing some overhang due to the passing of PBB’s founder, the late Tan Sri Teh Hong Piow, and a weak management team.

It is attributed to the lack of management succession planning and the uncertain ownership of the founder’s stock in PBB’s stock. Nevertheless, the current share price of PBank is declining.

Based on historical data and analyst forecasts, it has been shown that the pbank share price has started to drop since early 2023.

The current share price as of November 28, 2023, is RM4.22. On average, the share price in 2023 will be around RM3.5. The share price will drastically drop in June 2023.

Even if the publicbank share price is crawling to rise again, the share price still underperforms compared to other banking stocks in Malaysia.

Thus, there are many factors that affect the pbbank share price trend from time to time, which illustrates the performance of the Public Bank itself.

Is PB Bank Share Price A Good Buy

Public Bank operates its business in banking and financial services. Surely, investment in the banking industry guarantees a good return.

The current share price of Public Bank is RM4.12, which is over the fair value.

Therefore, every shareholder is entitled to a RM0.17 dividdend for every share they require.

This is quite good. By means, the publicbank offers a good share price to the shareholders.

Overall, it shows that Public Bank is growing and in a good position to make consistent dividdend payouts to its members.

A stable dividdend policy has been implemented by the Public Bank.

SOURCE: Yahoo Fiance

Is Public Bank A Good Stock

A company that recorded a high dividdend yield reflects good performance in terms of profitability, liquidity, leverage, and management.

Every investor will look at all these elements before they make their investment in the company.

This is to make sure that they will receive a high return on their investment.

The high dividdend yield recorded by the company can attract investors to make investments.

In the midst of economic challenges, Public Bank has successfully sustained its growth and profitability in operating its business in the banking industry.

As for the latest pbbank dividdend 2023 yield, it recorded 4.18%, slightly lower than the previous declaration.

However, Public Bank still sustains its business growth in order to achieve stability and growth for the company.

Public Bank Stock Price Today vs Maybank, Which One Better?

Public Bank and Maybank Berhad are both giant banking institutions in Malaysia.

One of their financial services is offering shares of stock to investors in order to operate their businesses and financial activities.

As a reference to the stock exchange, which is Bursa Malaysia, Maybank Berhad is the first leading banking institution to offer the stock at a sustainable price over the years, regardless of their financial performances.

However, since Public Bank started to propose bonus shares price with a ratio of four to one, it makes the PBB’s stocks look more attractive and affordable to investors.

This leading action by the PBB might surpass Maybank’s leading position in Bursa Malaysia. It seems possible for Public Bank, as the investors in PBBank are expected to gain positive economic data compared to Maybank due to the high share price offered to the investors.

Therefore, PB Bank is currently potentially offering better share price than Maybank’s stock.